dependent care fsa eligible expenses

Adult day care facilities. Below are the basic rules followed by our interpretation as they relate to standard service providers.

How To File A Dependent Care Fsa Claim 24hourflex

Elder care form parent or dependent.

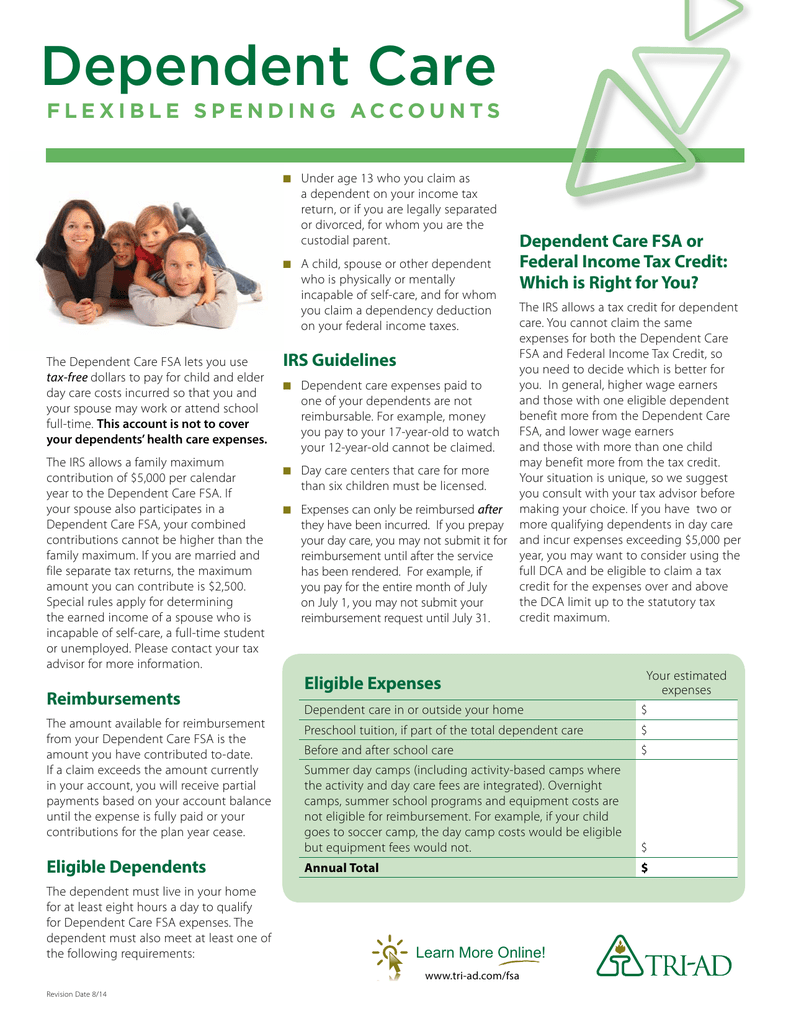

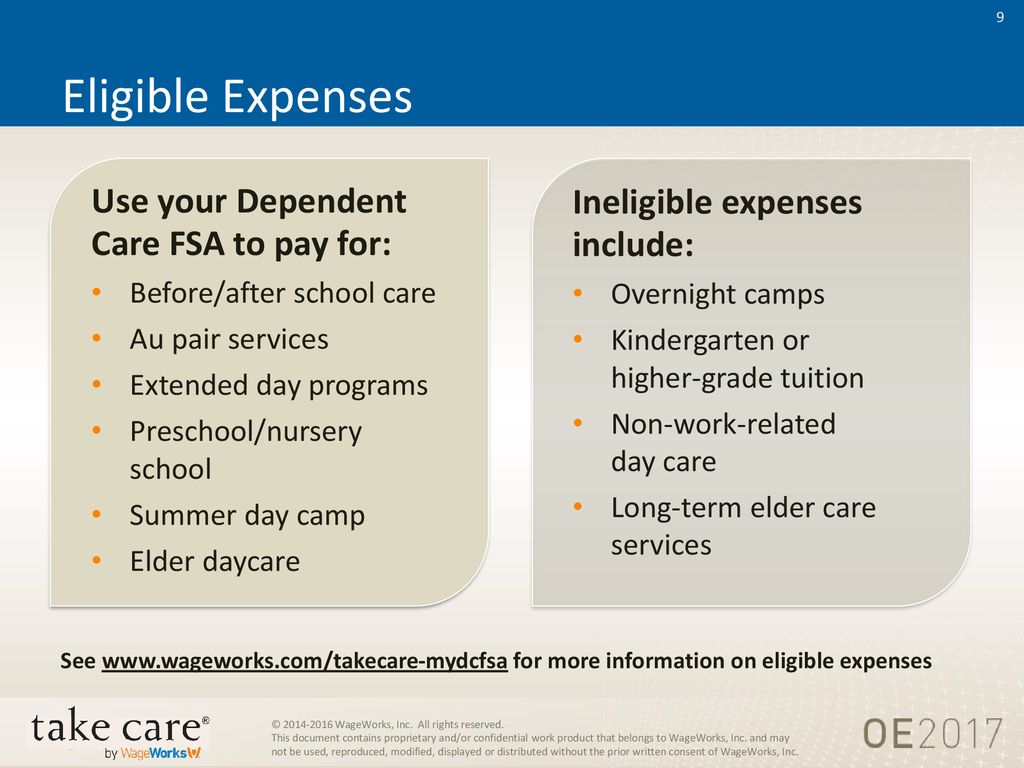

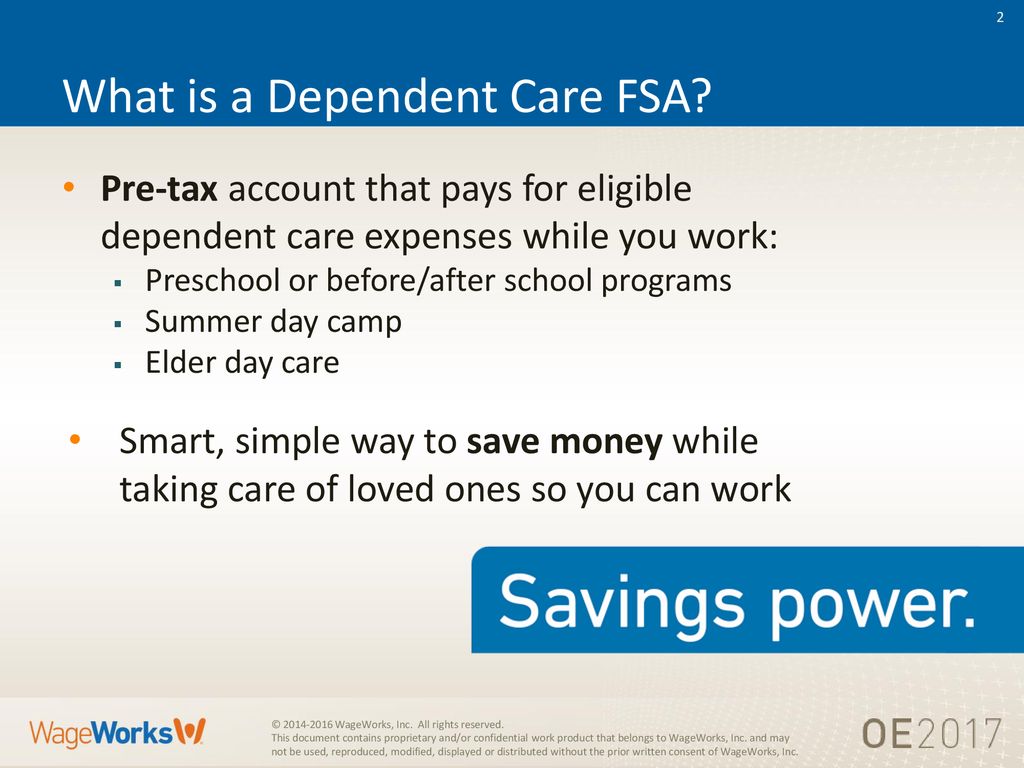

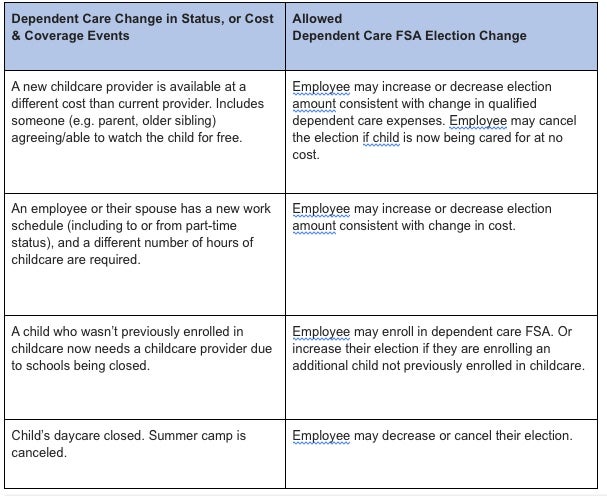

. A Dependent Care FSA may be used for eligible dependent care day care elder care expenses incurred so that you may work. Your Dependent Care FSA pays for various child and adult care services so you can go to work. Not all expenses can be covered using a dependent care FSA.

Ad Explore cost-saving strategies that wont reduce your employees benefits. In addition the IRS announced on March 26 2021 that personal protection equipment PPE purchased on or after 11. 6P033041 521 - FSA.

A Dependent Care FSA can cover expenses paid to a babysitter under the age of 19 as long as they are not your or your spouses child stepchild foster child or tax dependent. An exception may apply when the spouse is a full-time student or incapable of self-care. If you are enrolled in a Limited Medical FSA or Combination Medical FSA your eligible expenses may be different.

Transportation to and from eligible care provided by. If you exclude or deduct dependent care benefits pro- vided by a dependent care benefit plan the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses generally 3000 Schedule H Form 1040 W-10 Page 2 Publication 503 2020 httpswwwirsgovformcomments. Piano lessons for children Preschool.

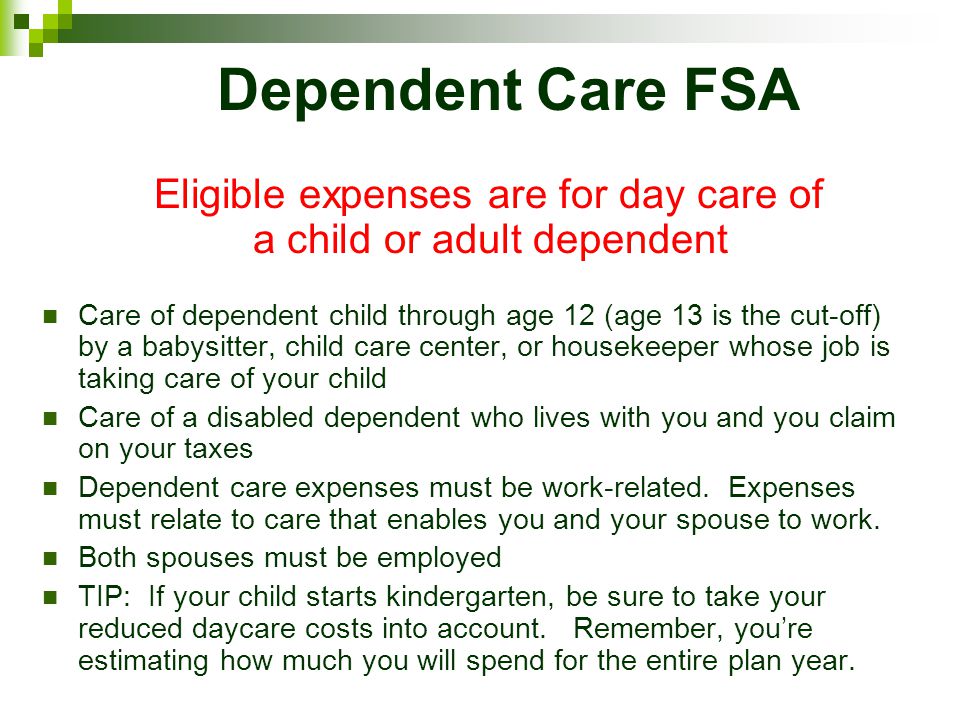

These expenses need to be work-related meaning you and your spouse must be working looking for work or attending school full-time. As of January 1 2020 over-the-counter OTC medicines as well as feminine care products are eligible for tax advantaged benefit plans such as FSAs HRAs and HSAs without a prescription or physicians note. Registration fees required for eligible care after actual services are received Sick-child care center.

Youll pay your dependent care costs directly and then apply for reimbursement. The IRS has outlined a list of Dependent Care FSA eligible expenses. The expenses must enable you and your spouse to work or look for a new job.

Dependent Care FSA Eligible Expenses. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including preschool nursery school day care before and after school care and summer day camp. If you are married your spouse must also work or go to school full time for at least five months within a calendar year the months do not need to be consecutive while you are at work to qualify for this plan.

Licensed day care centers. Private school tuition for kindergarten and up Registration fees required for eligible child care after actual services are received. Medical care for children or dependent adults Nanny for children Nursery school.

The most common FSA plans are the Healthcare Reimbursement Account Health FSA the Dependent Care Assistance Account Dependent Care FSA and the Limited Purpose FSA. Dependent Care Flexible Spending Account eligible expenses are more expansive than many parents realize and narrower than others hope. Examples of qualifying services include.

Eligible dependent care expenses. Nursing home care for dependent adults Payroll taxes related to eligible dependent care. Must be necessary in order to work Applies to spouse For dependents age 13 and under Qualified Health.

Qualified dependent care expenses Au pair services Babysitting services Before- and after-school programs Custodial or eldercare expenses in-home or daycare center not medical care Nursery school Pre-kindergarten Summer day camp not educational in nature Ineligible dependent care expenses Clothing Foodmeals. Placement fees for a dependent care provider such as an au pair. Each allows employees to set aside pre-tax dollars to be used for designated eligible expenses and is explained below.

Cover expenses for your childdependent. Qualified Dependent Care Expenses for your FSA Account. Learn more about the benefits of a dependent care FSA with PayFlex.

To qualify as an eligible expense the babysitters services must allow you. Nanny and Babysitter Pre-K or Nursery school Before-or after-school care Daycare for disabled adult or child. Your child must be under the age of 13 for you to use a Dependent Care FSA for their care expenses.

Expenses are generally only considered eligible for reimbursement under the Dependent Care Flexible Spending Account when the expense enables the employee and spouse if applicable to be gainfully employed or seek employment. Check your plan details for more information. Download a list of dependent care expenses by clicking here.

Before- and after-school care but not tuition Babysitters nannies and au pairs. Eligible expenses in an HRA will vary depending on plan design. If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent under the age of 13 as well as adult dependents based on dependents you claim on your tax returns for dependent care while you or your spouse work or look for work.

Dependent care FSA-eligible expenses include. Before school or after school care other than tuition Qualifying custodial care for dependent adults. Summer camps for dependent children under age 13.

If you exclude or deduct dependent care benefits provided by a dependent care benefit plan the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses generally 8000 if you had one qualifying person or 16000 if. Activity Fees Piano Lessons Dance Class Au pair. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services.

Childcare for dependents under the age of 13 -- at a day care center day camp sports camp nursery school or by a private sitter Before- and after-school care -- must be billed separately from tuition. Customized industry-leading solutions that have an average ROI of over 1700. CHILD CARE EXPENSE ELIGIBLE.

Nursery schools or pre-schools. Every family situation is different so we recommend consulting with a tax advisor if your specific expense does not fit into one of these categories. The key is that the account funds are used to cover care-related costs that allow you to work look for work or attend school.

Child Dependent Care Eligible Expenses Here is a list of the most common dependent care expenses. Payroll taxes related to eligible care. Preschoolnursery school for pre-kindergarten.

How A Dependent Care Fsa Can Enhance Your Benefits Package

File A Dca Claim American Fidelity

Dependent Care Open Enrollment 24hourflex

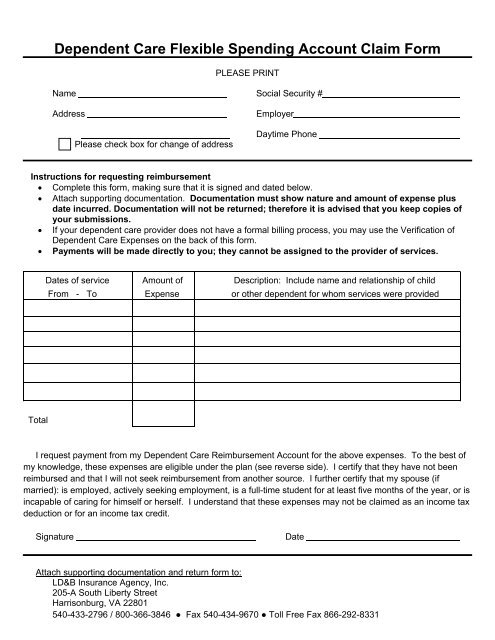

Dependent Care Flexible Spending Account Claim Form

Coh Dependent Care Reimbursement Plan

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

Your Flexible Spending Account Fsa Guide

Health Care And Dependent Care Fsas Infographic Optum Financial

2021 Wake Forest Benefits Guidebook By Wfu Talent Issuu

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Flexible Spending Account Nuesynergy

What Is A Dependent Care Fsa Wex Inc

Dependent Care Fsa Flexible Spending Account Ppt Download